At the expert discussion entitled „World, Europe, Ukraine – a view from the EU“, a number of speakers presented their view on the current and future dairy relationship between the Ukraine and the EU.

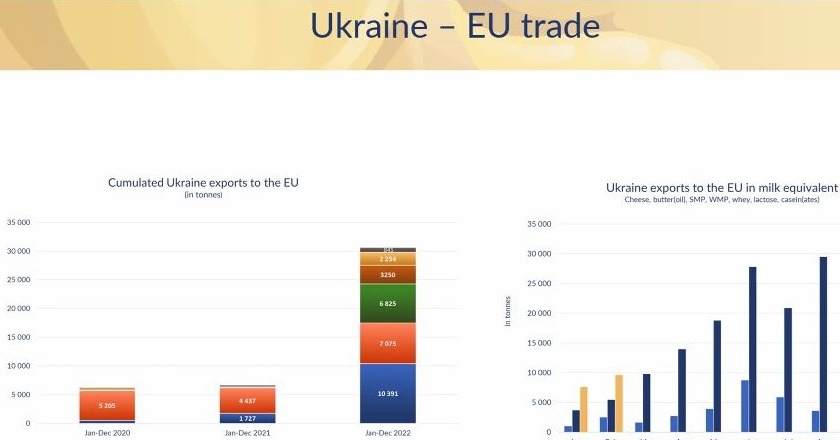

Alexander Anton, Secretary General of EDA (European Dairy Asscociation), pointed out that in a joint effort, together with Ukrainian association SMPU, milk and dairy were taken off the ‘trade restriction list’ of the five neighbouring countries to Ukraine as of today. „As long as dairy trade is based on reciprocity, we fully support the EU approach of 0 tarifs and 0 quota. As it stands, the Ukrainian lactosphere is fully integrated into the EU dairy sector.“, Anton said. Nevertheless, this ‘integration’ is limited by an approach that needs to be renewed every year and the logistic problems we face today (grain lorry jams at borders, drivers on strike). That’s why the EDA have commissioned a study on the 2030 dairy landscape in the EU and in Ukrainbe under the two assumptions: end of the war and long term integration of Ukraine dairy into the EU.

Alexander Anton, Secretary General of EDA (European Dairy Asscociation), pointed out that in a joint effort, together with Ukrainian association SMPU, milk and dairy were taken off the ‘trade restriction list’ of the five neighbouring countries to Ukraine as of today. „As long as dairy trade is based on reciprocity, we fully support the EU approach of 0 tarifs and 0 quota. As it stands, the Ukrainian lactosphere is fully integrated into the EU dairy sector.“, Anton said. Nevertheless, this ‘integration’ is limited by an approach that needs to be renewed every year and the logistic problems we face today (grain lorry jams at borders, drivers on strike). That’s why the EDA have commissioned a study on the 2030 dairy landscape in the EU and in Ukrainbe under the two assumptions: end of the war and long term integration of Ukraine dairy into the EU.

The UKR dairy sector is of high competitivity with a real dairy culture in terms of milk production, milk processing and milk consumption – that is also proven by the high commitment of international dairies in the country, Anton added. The volumes of milk processed by the Ukrainian dairy industry is now about 1/3 of the 8m tons of milk produced per year. Processors are fully aligned with international standards and milk is transformed into added value products that are fit for the international markets, incl the EU market.

Jukka Likitalo, General Secretary of Eucolait, favoured a fast accession of Ukraine to the EU. The EU Parliament’s vote on removing import duties on Ukraine-made dairy now only needs the stamp by Commission and the Council. Referring to the world milk market, Likitalo is positive that the decrease of orices thatvstarted by the turn of year will lead to increased demand and there are clear signs that Asian demand is recovering. However, it is advisable for any exporter not to rely too much on a single customer like China, Likitalo said.

Jukka Likitalo, General Secretary of Eucolait, favoured a fast accession of Ukraine to the EU. The EU Parliament’s vote on removing import duties on Ukraine-made dairy now only needs the stamp by Commission and the Council. Referring to the world milk market, Likitalo is positive that the decrease of orices thatvstarted by the turn of year will lead to increased demand and there are clear signs that Asian demand is recovering. However, it is advisable for any exporter not to rely too much on a single customer like China, Likitalo said.

Agnieszka Malіszewska, Vice-president of COGECA, Director of the Polish Dairy Chamber (representing 80% of the Polish 14.5m tons milk market), made clear that the decision by the Polish government to ban dairy imports from Ukraine was not discussed with the dairy sector. But as a matter of fact, Ukraine closed its borders in April to imports of Polish dairy products. This affected 6% of Polish cheese exports while dairy imports from Ukraine to Poland were always historically low. The ban by Poland for Ukrainian dairy seems to be a kind of retribution for the grain imports that affected mainly crop farmers. Malіszewska invited representatives of the European and Ukrainian dairy sector and officials to discuss dairy relations at an international forum that will be held in autumn in Poland.

Agnieszka Malіszewska, Vice-president of COGECA, Director of the Polish Dairy Chamber (representing 80% of the Polish 14.5m tons milk market), made clear that the decision by the Polish government to ban dairy imports from Ukraine was not discussed with the dairy sector. But as a matter of fact, Ukraine closed its borders in April to imports of Polish dairy products. This affected 6% of Polish cheese exports while dairy imports from Ukraine to Poland were always historically low. The ban by Poland for Ukrainian dairy seems to be a kind of retribution for the grain imports that affected mainly crop farmers. Malіszewska invited representatives of the European and Ukrainian dairy sector and officials to discuss dairy relations at an international forum that will be held in autumn in Poland.

This event was conducted jointly with the state institution “Entrepreneurship and Export Promotion Office” and the analytical agency INFAGRO supported by Switzerland within the framework of the Swiss-Ukrainian Program “Higher Value Added Trade from the Organic and Dairy Sector in Ukraine” implemented by the Research Institute of Organic Agriculture (FiBL, Switzerland) in partnership with SAFOSO AG (Switzerland), www.qftp.org.